presumptive taxation for service providers, presumptive taxation scheme for service providers,

Presumptive Taxation For Services in

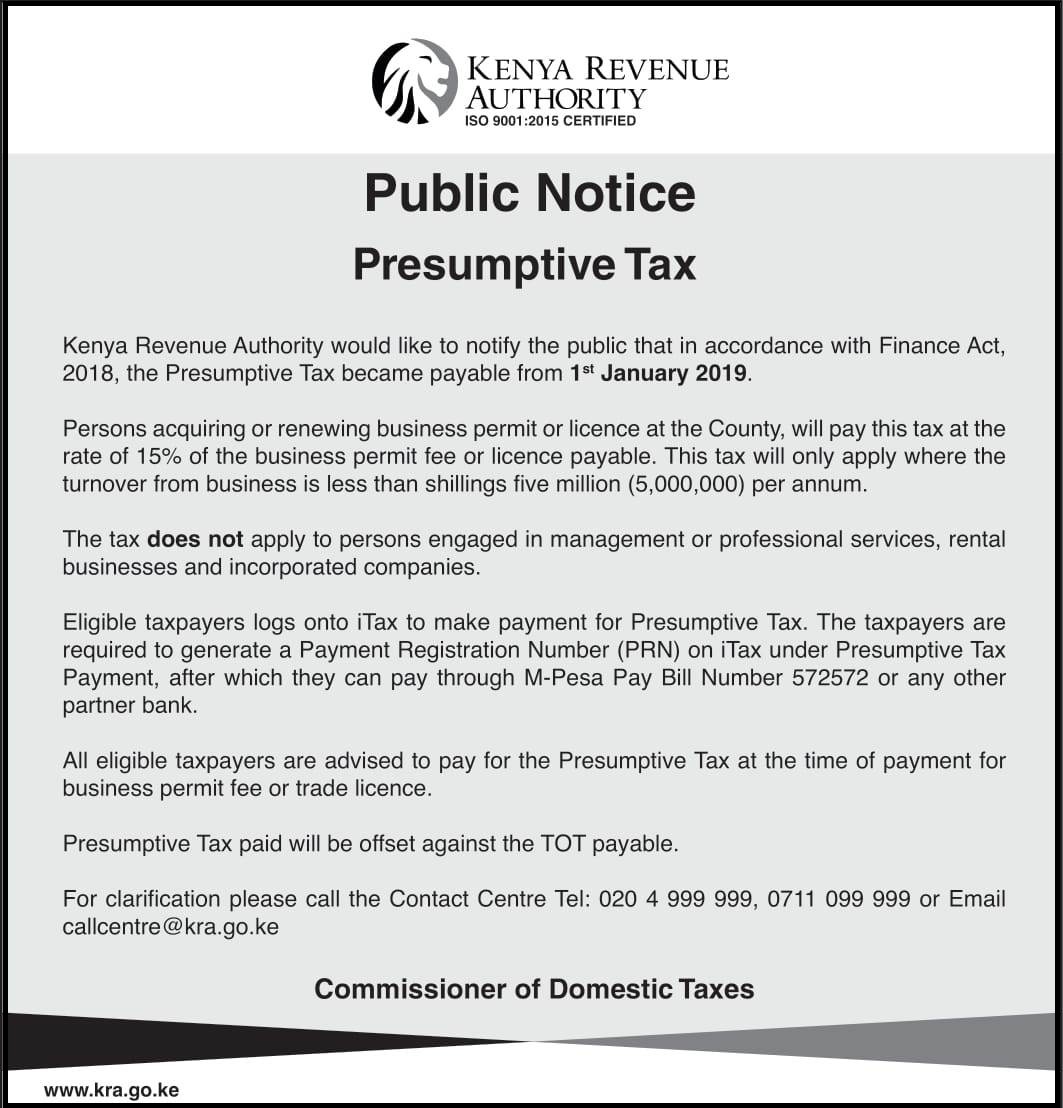

Presumptive Taxation For Services. Presumptive scheme of taxation means your income is calculated on an assumption instead of actual basis. The Presumptive Tax Scheme is formulated by Income Tax Laws which exempts the small businesses and traders to maintain the proper books of accounts and get them audited.

Under the first option, an assessee can compute taxable income on the basis of books of account.

Concept of taxation according to which income tax is based on "average" income instead of.

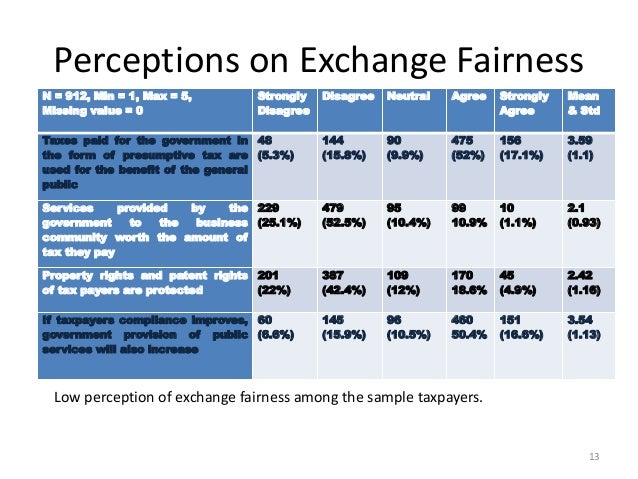

The results obtained are sunset policy, tax amnesty, tax sanctions, knowledge and understanding of taxes, and tax service has no. Presumptive taxation involves the use of indirect methods to calculate tax liability, which differ from the usual rules based on the taxpayer's accounts. When the income is calculated based on such conjectures or presumptions, the taxation applied on the income is known as presumptive taxation.

Likewise information about Presumptive Taxation For Services in